Download a PDF version of the letter here.

“My life has been a product of compound interest.”

~ Warren Buffett

“We have a passion for keeping things simple.”

~ Charlie Munger

On February 15th of 2008, I had the opportunity to visit the headquarters of Berkshire Hathaway for an Omaha Q&A session with Mr. Warren Buffett followed by lunch. It was a privilege to co-host our Texas grad school classmates for a two hour sit down with the Oracle of Omaha. The cost for us to meet with the greatest investor of all-time was $800, a bargain compared to the recent $19 million charity donation for the same experience. During our Q&A session, Mr. Buffett spent time discussing industry analysis, the qualities that make managers great, and the importance of temperament as well as how he perceives passion. He consistently threaded the conversation with one-liners of wisdom such as “Keep yourself in perspective.”

As we departed for Piccolo’s, Mr. Buffett offered my co-host and I either a ride in his Cadillac or a seat across from him while we dined. The ride in the grey Cadillac would have undoubtedly been a core memory, but I chose the seat at lunch. From my notes, “Mr. Buffett drank two cherry cokes, ate chicken parm, and barely touched his French fries…” Clearly, I did not want to forget any details of this time together. During our conversation, he highlighted that one of his best golf rounds was with President Reagan and he also mentioned he had never been to Japan (ironic given that he recently tripled his money investing in five Japanese trading firms).

After some of the back and forth slowed, I explained to him that I was close to receiving my dream job offer from an investment firm and essentially asked for his approval. He did not directly answer my question, but responded with the following indirect quote:

I’d go start my own firm if I were you. That’s how you learn this business. If you are meant to be an investor, you’ll be glad you did it on your own rather than working for someone else.

I left our lunch not able to fully comprehend his advice because of the surreal feeling that I had just dined with the richest man in the world. Recommending I start my own firm wasn’t the response I expected, and I wondered if following his advice was even feasible. As a reminder, this was 2008. Nobody was jumping out of their chair to hand over hard-earned wealth to a 28-year-old because he told them Mr. Buffett said so. I realized the only way this would be a possibility was to get the approval of Ray (my father) and Ron (my uncle), both remarkably successful investors in the public and private markets respectively. They would need to be the seed capital to the firm because as a student, the only money I had in my pocket jingled, whereas theirs folded.

“Hell no” was the response that Ray had when I asked him about exploring this opportunity. Ron was less curt and thought it sounded like an interesting idea, but he wanted me to put together a business plan. Ron’s extremely thorough due diligence process resulted in me needing a prescription for Propecia. But after much deliberation, he was convinced which led to Ray eventually approving. 14 years later, they are both still investors, and words don’t do justice for how grateful I am to them for helping get this firm started. I also owe a lifetime of gratitude to Mr. Buffett for his response. It’s amazing how encouraging words can result in action.

Not too long ago, I wrote to Mr. Buffett and thanked him for being so giving of his time. I told him I literally took his advice and that it changed my life. A picture of Mr. Buffett and me sits framed on my desk, alongside the letter he wrote in response to mine. In his reply letter is a phrase that subliminally highlights one of the single most important concepts to Mr. Buffett’s success of compounding capital: time. His last sentence begins, “It sounds like you are off to a great start …”

The Power of Compounding

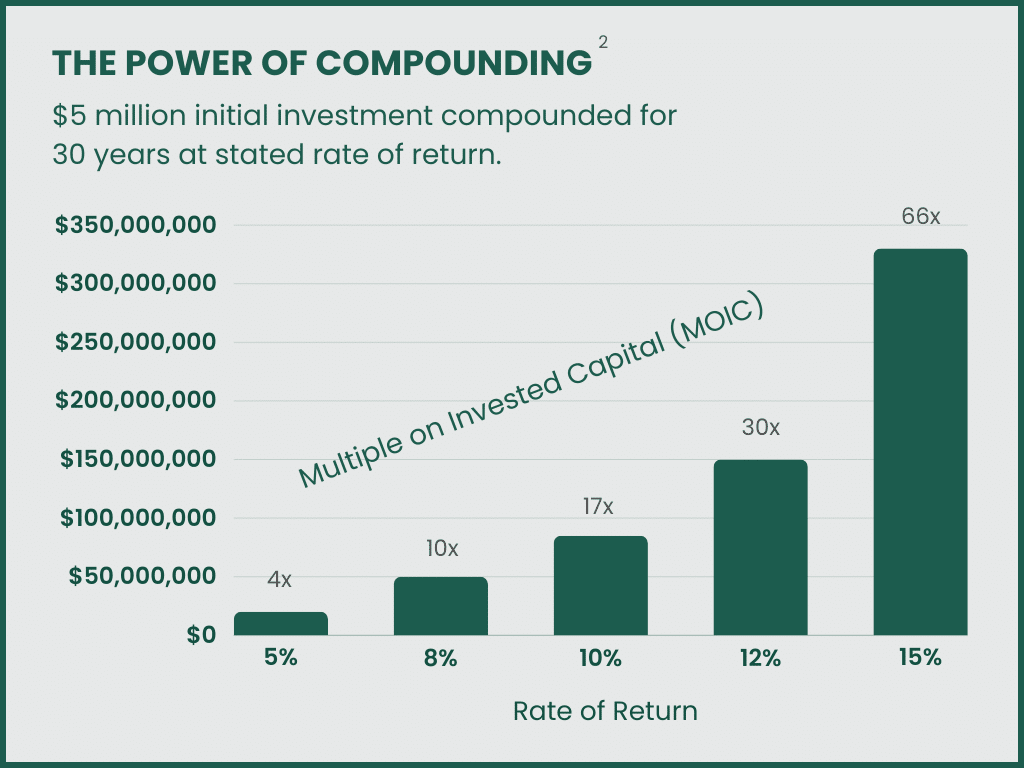

Many investors get lost in the world of investment instant gratification and they lose sight of the power of compounding over time. On our website we show one of the most important tables every investor should thoroughly understand. The graphic shows rates of return measured against time in years to highlight the number of times your wealth compounds. The middle of the table highlights that a 12% rate of return over 30 years will result in a 30x return on your money. Stated another way, a $5 million investment compounding at 12% a year for 30 years would be worth $150 million. The power of compounding capital is the cornerstone of our mission statement for building generational wealth for our investors, but one of the most important factors for achieving this goal is revering the importance of time.

CHART I

Disclaimer: The above is for illustrative purposes and not indicative of any investment. Data calculated by Nixon Capital.

Now back to the letter. “A great start”? We’d been investing for over a decade and managed portfolios through a trading flash crash, the sovereign debt crises, three US presidents, three US Fed Chairs, zero-percent interest rates, negative oil prices, COVID-19, culture wars, etc. and Mr. Buffett called it “a great start.” I initially thought this might have been written in jest. However, I believe he used that phrase intentionally to remind me of the importance of time’s impact on compounding.

Investors who hyper-focus on monthly or even 2-to-3-year returns should consider this fact: 90% of Buffett’s net worth was created after his 60th birthday. Once more, 12% compounded over 30 years is a 30x return on investment, but the exponential impact occurs in the final 10 years. As Mr. Buffett’s hero Ben Franklin said, “Money makes money. And the money that money makes, makes money.”

Charlie Munger’s Influence

Another well-known admirer of Ben Franklin’s wisdom was Warren Buffett’s partner, Charlie Munger. It was heartbreaking to hear the news that Mr. Munger passed away in November of last year, 34 days before his 100th birthday. We’ve never quoted Mr. Munger in all our years of writing letters, but we’d be remiss not to mention how much influence he’s had on our firm. While I was never able to meet Mr. Munger, something I’ll always regret, I’ve obsessively consumed his rational wisdom over the years. I’d argue that our investment philosophy aligns more closely with his than Mr. Buffett’s. Simply, we want to own a concentrated portfolio of great companies that are purchased at fair prices–and occasionally there are opportunities to buy/sell investments at very attractive prices. We will truly miss his honesty and humor; he was a legendary investor.

There are three Munger quotes that continue to inspire how we approach investing:

Be Patient: “The big money is not in the buying and selling … but in the waiting.”

Be Opportunistic: “Really good investment opportunities aren’t going to come along too often and won’t last too long, so you’ve got to be ready to act and have a prepared mind.”

Acknowledge Risks: “It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid instead of trying to be very intelligent.”

Buffett and Munger are investment geniuses, sui generis if you will. Attempting to imitate them has proven impossible while naming “the next…” just foolish. We humbly acknowledge the tremendous impact they have had on the Nixon Capital investment philosophy and recognize we will never match their success. Rather, this letter serves as a tribute and an appreciation to both men as they were formative investors for all of us. They are notable examples of what it means to be generous with your time and talents.

Closing Thoughts

A long-term buy and hold strategy in stocks has become an unconventional way to build wealth. It requires patience, preparedness, and the acknowledgment that the world is complex with many uncontrollable risk factors. Over the past 14 years we have made plenty of mistakes and misjudged risk. I can say with certainty there is a zero percent probability that it will not happen in the future. However, we have overcome difficult markets and learned from our mistakes by invoking Munger’s “Soldier on System.” In investing, just as in life, hardships are inevitable, and we must navigate through them by standing on the foundations and principles we believe in.

It is imperative in complicated environments to keep things simple. We will continue to evolve and improve upon our fundamental, value-biased approach to compound your wealth, recognizing the importance that time has on achieving a 30x return over 30 years.

As we start our 15th year, we appreciate that we would not be doing what we love if it were not for our excellent partners. We are profoundly grateful for our business relationships and have adhered to Mr. Munger’s advice on “choosing clients as we would friends.” We are as excited contemplating what is in store for the next 15 years as we were on Day One. We are just getting started.

The Nixon Capital Team

Any views expressed are subject to change at any time, and Nixon Capital disclaims any responsibility to update such views. Information contained herein has been obtained from various sources believed reliable but is not necessarily complete. Accuracy is not guaranteed. Any reliance placed on opinions and assumptions herein is done at your own risk. Nixon Capital has not reviewed any of the websites that may be linked to this letter and is not responsible for their content. Nixon Capital is not responsible for the privacy practices of such other websites. Discussions of individual securities are intended to inform shareholders as to the basis (in whole or in part) for previously made decisions by the firm to buy, sell or hold a security in a portfolio. References to specific securities are not intended and should not be relied upon as the basis for anyone to buy, sell or hold any security. Portfolio holdings and asset allocations may not be representative of the portfolio manager’s current or future investment and are subject to change at any time. This information is not to be reproduced or redistributed to any other person without the prior consent of Nixon Capital LLC.